Learn GST: Filing & Registration on portal

*Learn & Practise on Live GST & E-way Bill Portal

Our Indore-based institute offers comprehensive training and assistance for GST filing and registration. Learn the process, from initial registration to filing returns.

Here's what you'll learn:

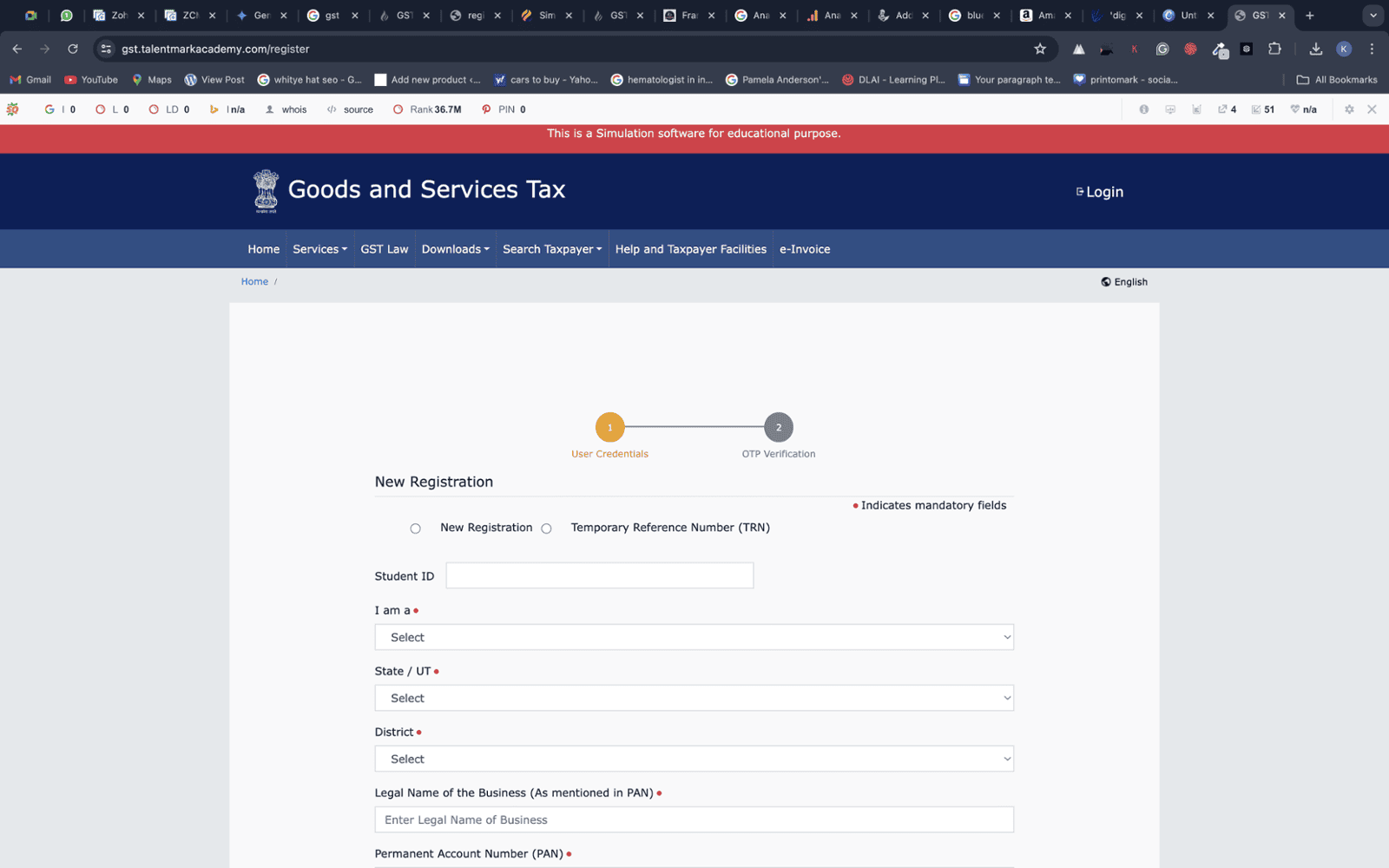

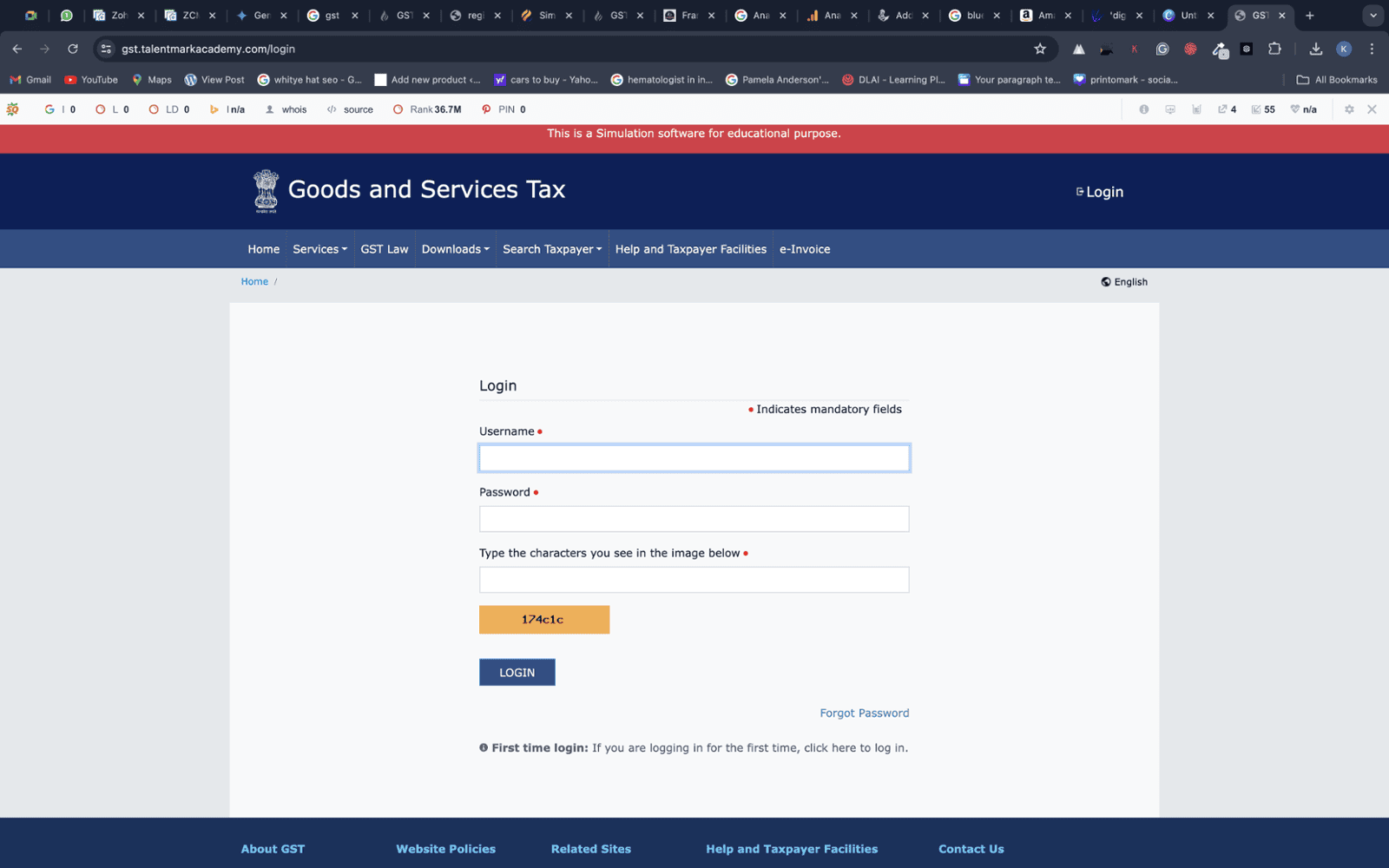

Registration

Start your GST journey with us! Our simulation software guides you through the initial steps of GST registration on the look a-like portal. Get hands-on experience by filling out Parts A and B of the GST REG-01 form with real-world data.

GSTR1 FILING

GSTR1 FILING

This monthly or quarterly return is crucial for businesses making outward supplies of goods or services. Our platform provides a user-friendly learning environment to understand the difficulty of GSTR-1 filing.

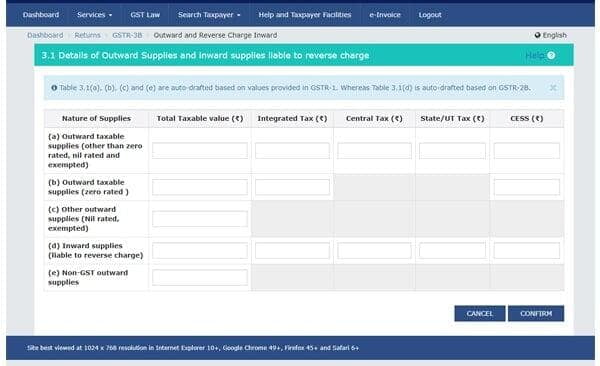

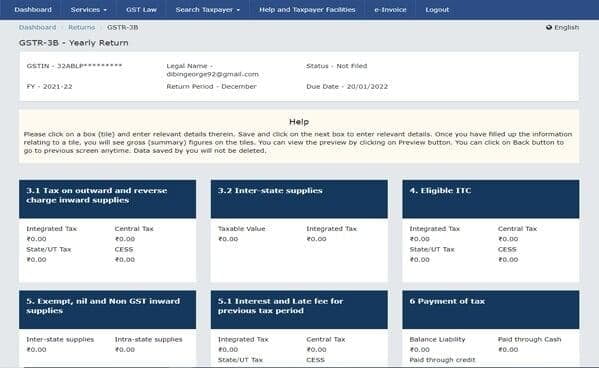

GSTR - 3B FILING

GSTR - 3B FILING

Learn the easy way to file your GST taxes! The GSTR 3B form helps you report and pay your GST for a specific period. We can show you how to use it with no sweat!

GSTR 2A – 2B

GSTR 2A – 2B

Our simulation portal allows you to see details of purchases you made from other businesses (GSTR-2A) and the tax credit you can claim on those purchases (GSTR-2B). This helps you get comfortable with the real GST filing process.

GSTR1 AMENDMENT

GSTR1 AMENDMENT

Unlike real GST filing, our portal lets you experiment with amending a GSTR-1 return. Remember that, actual GST regulations don't allow revising a filed return. However, you can rectify any errors by filing amendments in the subsequent GSTR-1 for the following month or quarter. Get hands-on experience and ensure accurate GST filing with our look a like GST portal!

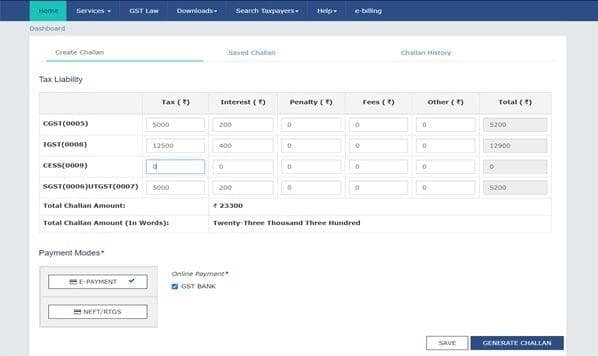

CHALLAN CREATION

CHALLAN CREATION

Practice creating the PMT-06 challan, the official form for paying GST taxes, interest, late fees, and penalties. Gain confidence in handling GST payments before dealing with real transactions.

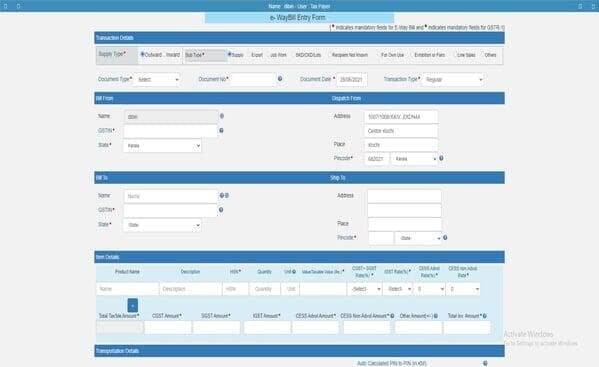

E – WAY BILL

E – WAY BILL

Our platform provides a simulated environment for you to learn the ins and outs of generating and managing e-way bills, just like on the GST portal. Practice issuing, cancelling, and tracking e-way bills risk-free !

INVOICES UPLOADED BY E COMMERCE

INVOICES UPLOADED BY E COMMERCE

Table 14: For invoices where the e-commerce operator collects Tax Collected at Source (TCS) under Section 52.

Table 15: For invoices where the e-commerce operator is liable to pay tax under Section 9(5).

We will teach you well:

Want to Prepare GST Returns ?

Contact us now to get more details on how can you practise filing GST Returns.